Life in India is full of dreams — a home, a car, higher studies for kids, a steady business. Most of us use loans to build these dreams. But when personal loan EMIs, car loan EMIs, credit card dues, and business loan EMIs all knock on the same month, it becomes hard to breathe. That’s where an EMI Consolidation Loan (also called a debt consolidation loan) becomes a lifesaver. This article explains, in plain Indian tone, everything you need to know — how it works, all loan types, benefits, eligibility, documents, pitfalls to avoid, and tips to help you find the best EMI consolidation loan in India.

Table of Contents

Why read this?

If you’re searching on Google for phrases like “how to reduce EMI burden in India”, “combine multiple EMIs into one”, “loan to pay off all EMIs”, or “credit card debt consolidation loan” — this guide is built for you.

Quick snapshot: How to reduce EMI burden in India?

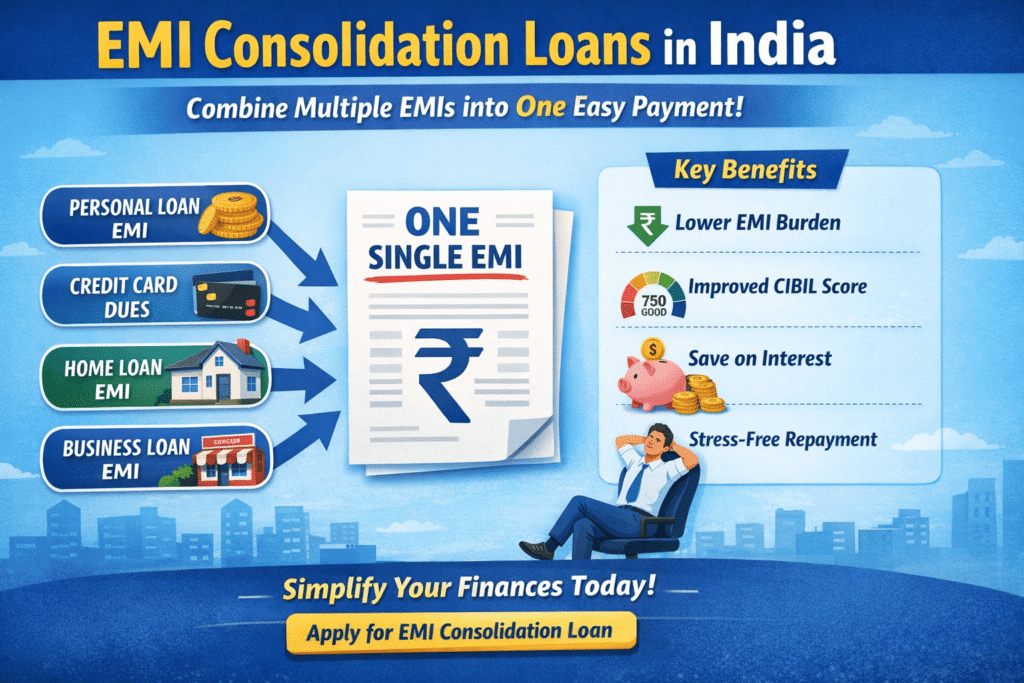

- What it does: Converts multiple EMIs into one single EMI.

- Who it helps: Salaried people, self-employed, MSMEs, and anyone with multiple EMI obligations.

- Outcome: Simpler finances, often lower monthly payout, and better cash flow.

What is an EMI Consolidation Loan?

An EMI consolidation loan replaces several existing loans (credit card dues, personal loans, car loans, business loans) with one new loan. The new loan is used to close the earlier accounts, and you then repay just one EMI — typically at a lower interest rate or with a longer tenure. The goal: reduce stress, manage money better, and possibly save on interest.

Also called: debt consolidation loan India, loan EMI consolidation, single EMI loan for multiple loans.

Why EMI Consolidation Loans are Trending in India?

- Rising living costs and financial commitments.

- High credit card interest rates that eat into savings.

- People juggling different payment dates and lenders.

- Desire for better budgeting — one EMI is easier to plan for.

- MSMEs and small businesses seeking to convert short-term debt into manageable EMIs.

If you Searchsuch as “EMI reduction loan”, “combine all loans into one EMI”, and “EMI consolidation loan eligibility” on google, this article is make for you.

How EMI Consolidation Works — Step by Step

- Assess all debts: List loan balances, interest rates, EMIs, and lenders.

- Choose loan type: Personal loan, Loan Against Property (LAP), business consolidation, or balance transfer for credit card debt.

- Apply: Submit documents and loan application to a bank or NBFC.

- Lender pays off: The consolidation loan pays existing lenders to close accounts.

- One EMI: You now repay the consolidation loan with a single EMI.

Tip: Always run an EMI consolidation loan calculator to see monthly EMI and total interest before you sign.

Types of EMI Consolidation Loans in India

1) Personal Loan for EMI Consolidation

- Best for: Salaried professionals or self-employed with multiple small to medium loans.

- Why choose: Unsecured (no property needed), fast disbursal, flexibility.

- Keywords: personal loan for EMI consolidation, unsecured consolidation loan.

2) Loan Against Property (LAP)

- Best for: High outstanding balances requiring a lower interest rate.

- Why choose: Lower interest vs unsecured loans, higher loan amounts, longer tenure.

- Keywords: loan against property for debt consolidation, LAP EMI reduction loan.

3) Business Loan Consolidation

- Best for: MSMEs, traders, and business owners with multiple business loans or OD limits.

- Why choose: Converts short-term working capital debt into structured EMIs; improves cash flow.

- Keywords: business loan consolidation India, MSME EMI consolidation loan, overdraft to term loan conversion.

4) Credit Card Debt Consolidation (Balance Transfer / Personal Loan)

- Best for: Those struggling with high-interest credit card dues.

- Why choose: Convert revolving credit into fixed EMI, reduce interest pain.

- Keywords: credit card debt consolidation loan, loan to close credit card dues.

5) Overdraft to Term Loan Conversion

- Best for: Businesses using heavy OD facilities.

- Why choose: Stabilizes repayment, reduces volatility of interest cost.

- Keywords: OD limit consolidation loan, overdraft to term loan conversion.

Benefits of Consolidating EMIs

- One simple EMI instead of multiple payments.

- Lower monthly burden — often achievable by extending tenure or getting a lower rate.

- Improved cash flow — frees up funds for savings or investments.

- Better mental peace — fewer due dates and fewer reminders from lenders.

- Potential for a better CIBIL score — if you close delinquent accounts and maintain timely payments.

- Reduced interest in some cases — especially when moving from high-rate credit cards to a lower-rate consolidation loan.

Realistic Interest Rates (Indicative)

Note: Rates vary by lender, loan type, borrower profile, and market conditions. These are approximate ranges to help you plan.

- Personal loan for consolidation: ~10.5% – 24% p.a.

- Loan Against Property (LAP): ~8.75% – 12.5% p.a.

- Business consolidation loan: ~11% – 22% p.a.

- Credit card balance transfer: Intro offers vary — always check the full term rate after the promotional period.

Always compare processing fees, prepayment charges, and hidden charges along with interest rate.

Eligibility — Who Can Apply?

- Age: Usually 25–60 years.

- Stable income — salary or business income.

- Minimum employment or business vintage (24-36 months common).

- Reasonable CIBIL score (700+ preferred) — but NBFCs and secured options may accept lower CIBIL scores(650+).

- Proof of existing loans/EMIs to consolidate.

Documents Required (Typical)

- Identity: PAN, Aadhaar, Passport (if needed).

- Address proof: Utility bills, Aadhaar, passport.

- Income proof: Salary slips (3-6 months) or ITR / business financials.

- Bank statements: Last 6 to 12 months.

- Existing loan statements: For all accounts to be closed.

- Property paperwork: If LAP is chosen.

EMI Consolidation Loan Calculator — Why Use It?

Before you apply, plug numbers into an EMI consolidation loan calculator to know:

- Your new monthly EMI.

- Total interest payable over tenure.

- Potential monthly savings.

- Break-even period (when savings from lower EMI offset processing fees).

This helps you avoid surprises and choose the best tenure.

EMI Consolidation Loan vs Balance Transfer — Quick Comparison

- Scope: Consolidation handles multiple loans; balance transfer usually moves a single credit card or loan to a new lender.

- Tenure flexibility: Consolidation often allows longer tenure; balance transfer may be shorter.

- Best for: Multiple EMIs → consolidation. Single high-rate credit card → balance transfer or personal loan.

Common Mistakes Borrowers Make

- Consolidating and then taking fresh loans again.

- Ignoring processing fees and hidden costs.

- Choosing a very long tenure without checking total interest.

- Not comparing multiple lenders or offers.

- Failing to factor in prepayment or foreclosure charges.

How to Choose the Best EMI Consolidation Loan in India?

- Compare APRs — not just headline rate; include fees.

- Check tenure options — shorter tenure means less interest but higher monthly payment.

- Read T&Cs for prepayment and foreclosure.

- Use a credible EMI consolidation loan calculator.

- Prefer regulated banks/NBFCs with clear customer support.

- Check for special offers for salaried & senior citizens.

Decorated Example — Realistic Use Cases

Case 1 — Raj, 34, Software Engineer (Salaried)

- Loans: Home loan (EMI), Car loan, Personal loan, One credit card.

- Problem: Multiple EMIs hitting salary account; tracking payments was stressful.

- Solution: Took a personal loan for EMI consolidation, closed the credit card and personal loan, now pays one lower EMI and uses remaining income to build an emergency fund.

Case 2 — Priya, 40, Proprietor (Small Business)

- Loans: Overdraft facility, Equipment loan, Business term loan.

- Problem: Variable OD interest and short-term repayments affected cash flow.

- Solution: Converted OD + equipment loan into a business consolidation loan with longer tenure — predictability returned and monthly obligations eased.

Frequently Asked Questions (FAQ)

Q1 — Can I consolidate loans with a low CIBIL score?

Yes — options exist, especially via secured loans like LAP or lenders who specialise in lower-CIBIL applicants. But expect higher rates or stricter terms.

Q2 — Does EMI consolidation hurt my credit score?

Initially it may show a new large loan and closed accounts, but if you make timely payments, consolidation can improve your credit profile over time.

Q3 — Can I consolidate credit card and personal loan together?

Absolutely. Many lenders allow credit card + personal loan consolidation to convert revolving credit into fixed EMI.

Q4 — What are the hidden costs?

Watch out for processing fees, foreclosure charges on existing loans, documentation charges, and late payment penalties.

Q5 — How soon will I see savings?

If your consolidation interest rate is lower than the weighted average of your previous loans, you’ll typically start saving on monthly outflow immediately.

Pros and Cons — Quick Look

Pros:

- One EMI, one date — simpler life.

- Possible lower monthly payment.

- Easier financial planning.

- Focus on savings/investments once cash flow improves.

Cons:

- Longer tenure may increase total interest paid.

- Processing and foreclosure fees can reduce short-term gains.

- Risk of overspending once credit accounts are closed.

Final Checklist Before You Apply

- Calculate new EMI and total interest using an EMI consolidation calculator.

- Check processing fee and compare ranks of lenders.

- Ensure consolidated loan interest is lower than weighted average of old loans.

- Read prepayment and foreclosure rules.

- Keep emergency fund in place — don’t refinance into longer-term debt without caution.

Closing Thoughts (Friendly Advice)

If your months feel crowded with multiple EMIs, an EMI Consolidation Loan in India can bring calm, clarity, and breathing space. It’s not a magic wand — but a powerful tool if used wisely. Compare lenders, read the terms, and pick a plan that fits your monthly budget and future goals.

Call to Action

Feeling overwhelmed with multiple EMIs? Use an EMI consolidation loan calculator today and see how much you could save. Search for “best EMI consolidation loan in India” or “EMI consolidation loan near me”, compare offers from banks and NBFCs, and choose the option that brings financial freedom.

If you want, I can help you: Call 📞 9015552537