The New tax slab 2025 has been a hot topic ever since the Indian government announced changes in income tax rates for the financial year 2025-26. With the Budget 2025 income tax updates, the government aims to provide relief to the middle class, improve tax compliance, and boost the economy. Individuals earning up to ₹12 lakh can avail of a rebate under Section 87A, making them effectively tax-free.

In this article, we will explore the latest tax slab in India 2025, compare the old vs. new regime tax slab 2025, discuss the impact on salaried employees, and analyze whether the new system benefits taxpayers. If you are wondering, which tax regime is better in 2025, we will break down the key factors to help you make an informed decision.

Table of Contents

New Income Tax Slab 2025-26

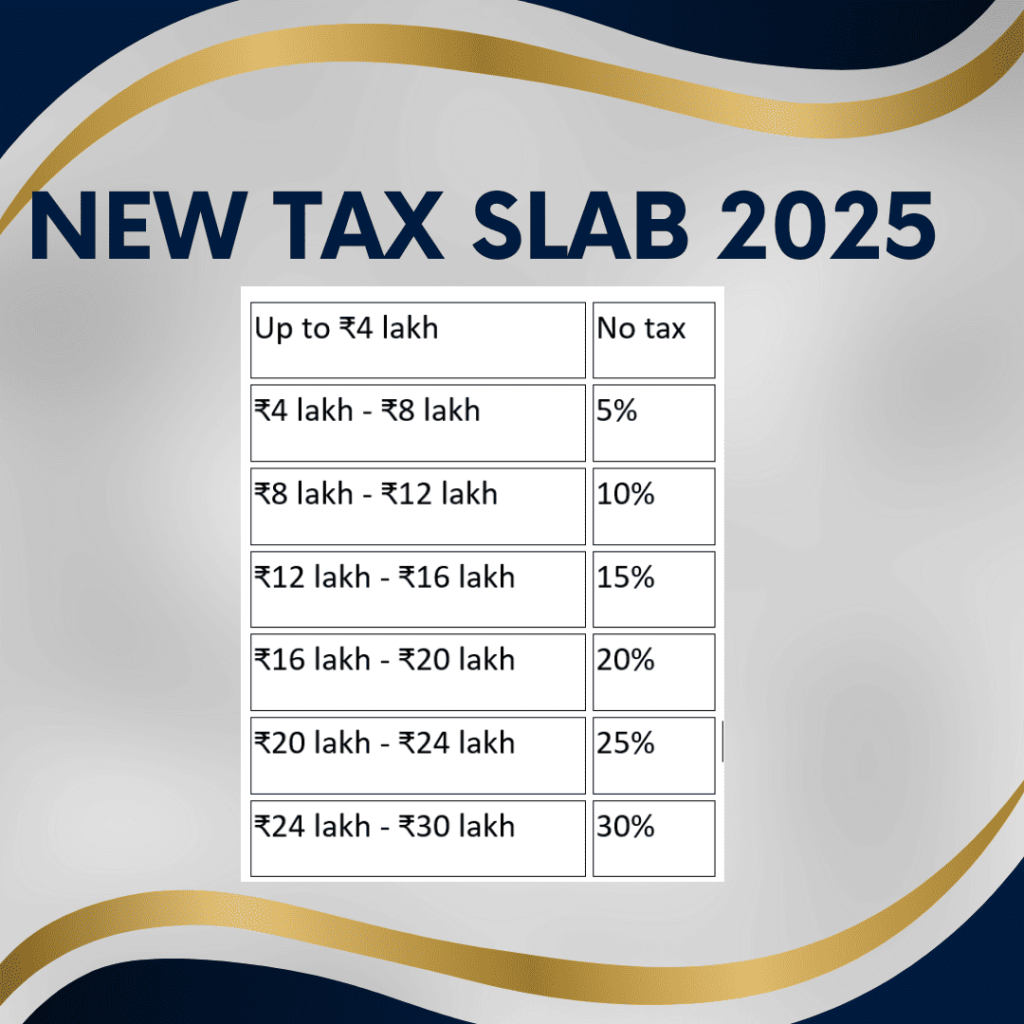

The government has revised the income New tax slab 2025-26 to make taxation simpler and more beneficial for taxpayers. Here are the updated tax slabs under the new regime:

| Income Range (Annual) | Tax Rate |

| Up to ₹4 lakh | No tax |

| ₹4 lakh – ₹8 lakh | 5% |

| ₹8 lakh – ₹12 lakh | 10% |

| ₹12 lakh – ₹16 lakh | 15% |

| ₹16 lakh – ₹20 lakh | 20% |

| ₹20 lakh – ₹24 lakh | 25% |

| ₹24 lakh – ₹30 lakh | 30% |

Key Changes in the New tax slab 2025

- Tax exemption limits in the New tax slab 2025 have increased, giving relief to lower-income individuals.

- The standard deduction in New tax slab 2025 has been hiked from ₹50,000 to ₹75,000.

- Individuals earning up to ₹12 lakh can avail of a rebate under Section 87A, making them effectively tax-free.

- Corporate and small business tax rates have remained unchanged.

New Regime vs. Old Regime Tax Slab 2025: Which One is Better?

With the new tax slab 2025, taxpayers now have to decide between the old vs. new tax regime. Let’s compare the two:

Old Regime (Before 2025)

✅ Deductions available under 80C (₹1.5 lakh), 80D (₹25,000 for health insurance), HRA, and other exemptions.

✅ Suitable for individuals with significant investments in tax-saving schemes.

🚫 Higher tax rates compared to the new regime.

New Regime (2025 Onwards)

✅ Lower tax rates with increased tax exemption limits.

✅ Simplified tax structure, fewer exemptions, and deductions.

🚫 No deductions under Section 80C, 80D, or HRA exemptions.

Which tax regime is better in 2025?

- If you have higher investments in tax-saving instruments, the old regime might be more beneficial.

- If you prefer higher take-home salary with fewer deductions, the new regime could be the better choice.

Impact on Salaried Employees

For salaried professionals, the Budget 2025 income tax changes bring relief through the increased standard deduction in tax slab 2025. The new standard deduction of ₹75,000 reduces taxable income, effectively increasing savings.

For example, if a salaried employee earns ₹12 lakh annually:

- Under the old tax regime, they could claim deductions under 80C and 80D but faced a higher tax rate.

- Under the new tax regime, they enjoy a lower tax rate without needing investments in tax-saving schemes.

The new system benefits individuals who do not invest heavily in tax-saving instruments and prefer immediate relief through lower tax rates.

How Does the New Tax Slab Affect Middle-Class Spending?

The latest tax slab in India 2025 has been designed to encourage spending by increasing disposable income. Lower tax rates mean that individuals will have more money to spend, potentially boosting sectors like:

- Real Estate: Higher disposable income can lead to increased home purchases.

- Automobiles: Car sales may rise as people feel more financially secure.

- Retail and Consumer Goods: More spending power means increased demand for products and services.

Experts predict that these tax cuts will stimulate economic growth while maintaining a balance between revenue generation and taxpayer relief.

Tax Rebate Updates 2025: What You Need to Know

In addition to changes in the tax slabs, the tax rebate updates 2025 include:

- Rebate under Section 87A: Individuals earning up to ₹12 lakh pay zero tax.

- Increase in standard deduction: Salaried employees benefit from a higher deduction of ₹75,000.

- No changes in corporate tax rates, ensuring stability for businesses.

Standard Deduction in Tax Slab 2025: How It Benefits You

The increase in standard deduction in tax slab 2025 is great news for salaried employees and pensioners. It simplifies taxation by automatically reducing taxable income, leading to lower tax liability without requiring proof of expenses or investments.

For example, under the new rules:

- A person earning ₹12 lakh annually now gets a ₹75,000 standard deduction, after adding standard taxable income to ₹12.75 lakh.

- This directly reduces tax outflow, increasing savings.

Corporate Tax Rates 2025: No Major Changes

While individual taxpayers have seen relief, the government has kept corporate tax rates stable. Businesses will continue to pay:

- 25% tax for domestic companies with a turnover of up to ₹400 crore.

- 30% tax for companies with a turnover above ₹400 crore.

- Reduced tax rates for startups and MSMEs to encourage growth.

This consistency in corporate taxation ensures businesses can plan ahead without sudden financial burdens.

Which Tax Regime is Better in 2025? Final Verdict

For taxpayers wondering which tax regime is better in 2025, the choice depends on individual financial goals:

- Old regime: Better for those with tax-saving investments.

- New regime: Ideal for those seeking immediate tax relief without deductions.

To maximize savings, taxpayers should calculate their liabilities under both regimes before making a decision.

Conclusion

The new tax slab 2025 has introduced significant reforms aimed at reducing the tax burden on individuals while boosting economic growth. With increased tax exemption limits in the 2025 income tax slab, higher standard deductions, and rebates, most middle-class taxpayers will benefit from greater disposable income.

The key takeaway is that taxpayers must compare the old vs. new regime tax slab 2025 based on their financial situation to optimize tax savings. Whether you are a salaried employee, a business owner, or a self-employed individual, understanding these tax rebate updates 2025 will help you make the right decision for your financial future.

With these updates, India moves toward a simpler and more taxpayer-friendly system, ensuring economic progress while keeping compliance straightforward

HOW TO APPLY FOR BUSINESS LOAN IN INDIA